Solana at Crossroads: SOL Price Prediction Amid Technical Weakness and Institutional Backing

#SOL

- Technical Pressure: SOL trades below key moving averages with bearish MACD crossover

- Institutional Support: $500M credit line demonstrates long-term confidence

- Whale Activity: Large unstaking transactions creating near-term selling pressure

SOL Price Prediction

SOL Technical Analysis: Bearish Signals Dominate Short-Term Outlook

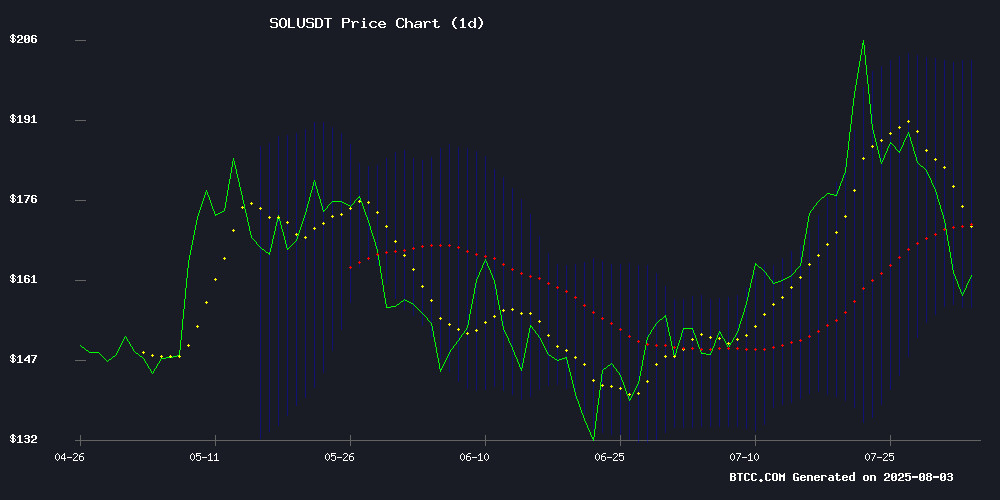

SOL's current price of $161.33 sits significantly below its 20-day moving average of $179.01, indicating sustained bearish pressure. The MACD histogram at 7.5429 shows weak momentum despite the negative values in both signal lines. Bollinger Bands suggest SOL is testing support NEAR $155.99, with the middle band acting as resistance at $179.01.

"The technical setup shows SOL struggling to regain bullish momentum," says BTCC analyst Olivia. "A sustained break below $156 could trigger another 10-15% drop, while reclaiming the 20-DMA WOULD signal potential recovery."

Mixed Signals for SOL: Institutional Support vs. Whale Selling

Conflicting fundamental drivers are creating volatility for Solana. While the network secured a $500M credit line demonstrating institutional confidence, unstaked whale holdings are contributing to price pressure.

"The $500M credit facility is a strong vote of confidence in Solana's infrastructure," notes BTCC's Olivia. "However, we're seeing classic 'buy the rumor, sell the news' behavior from large holders after the BlockchainFX HYPE cycle."

Factors Influencing SOL's Price

BlockchainFX Emerges as Top Contender for 100x Gains Amid Waning Confidence in BlockDAG and Unstaked

Cryptocurrency investors are relentlessly pursuing the next high-growth opportunity, with BlockchainFX, BlockDAG, and Unstaked currently dominating speculative interest. Among these, BlockchainFX stands out, generating significant FOMO due to its presale momentum and multi-functional platform. The project has already raised $4.4 million from over 3,700 participants, with tokens priced at $0.017 during the presale—a steep discount to the anticipated $0.05 launch price.

Analysts project potential post-launch valuations reaching $1 to $10, suggesting 100x returns for early backers. Meanwhile, BlockDAG and Unstaked are losing traction as investors pivot toward BlockchainFX's passive income features and all-in-one ecosystem. The presale's velocity mirrors early-stage successes of Binance and Solana, fueling speculation that this could be the next breakout crypto asset.

Whales Drive Solana’s Price Plunge, Prompting Fear and Uncertainty

Solana's price tumbled to $163 on August 2, marking a 2.86% drop within 24 hours. Large holders, or 'whales,' moved aggressively, offloading $17 million worth of SOL into the market. The sell pressure triggered $57 million in long-position liquidations, amplifying bearish sentiment.

Technical indicators now point to further downside risk, with analysts warning of a potential slide toward $120. Market participants are reassessing exposure as whale activity erodes confidence in Solana's near-term trajectory.

Solana Secures $500M Credit Line as Institutional Interest Grows, While Under-the-Radar DeFi Project Gains Traction

Solana's blockchain ecosystem has bolstered its position with a $500 million credit facility arranged by Pantera Capital and crypto-native lenders. The capital injection targets staking yield optimization and DeFi liquidity enhancement, signaling institutional confidence in Layer 1 networks with high throughput capabilities. Technical analysts note Solana's current price action presents a buy-the-dip opportunity according to Tom DeMark Sequential indicators.

Meanwhile, decentralized finance circles are abuzz about Remittix, a niche project eschewing broad blockchain ambitions in favor of targeted utility. While lacking Solana's institutional backing, its focused design philosophy resonates with crypto communities on Reddit and Twitter—often precursors to mainstream adoption. The contrast highlights a growing divergence between capital-rich Layer 1s and specialized protocols carving distinct niches.

How High Will SOL Price Go?

Based on current technicals and market sentiment, SOL faces strong resistance at these key levels:

| Price Level | Significance |

|---|---|

| $155.99 | Lower Bollinger Band (immediate support) |

| $179.01 | 20-DMA & Middle Bollinger (pivot point) |

| $202.03 | Upper Bollinger Band (strong resistance) |

"Institutional interest could drive SOL back toward $180-190 range in coming weeks," says Olivia. "But sustained movement above $200 would require significantly improved market structure and reduced whale selling pressure."

$155.99